5 Ways to Increase Your Tax Return

Taxes are inescapable, but you may reduce their impact by submitting a tax return each year. Whether you’ve invested the money or committed substantial payments for loans, vacation, or insurance, this is time to think back on a year and maximise the deductions & thus further reducing the overall tax load.

A tax return might make anyone feel wealthy and encourage them to overspend on unneeded items. Tax Experts advise taxpayers to remember that this is not extra income; the government is not handing you a reward check; that’s your money. Attempt to think of your tax return as a monthly income with a purpose. Consider your economic targets and how you will spend the money.

A tax return can be prepared for a customer by anybody with a Preparer Tax Identification Number. On the other hand, tax return preparers have varying degrees of competence, education, & expertise. This accessible database is designed to assist you in making your decision by identifying tax experts in your region. This presently possesses professional certifications recognised by the IRS lookup and has a Yearly Filing Period Program Proof of Completion.

Reconsider your filing condition

Among the first choices, you take when submitting your tax return, selecting a file status might impact the amount of the refund, primarily if you’re engaged. While over 96 per cent of married partners file tax returns together each year, doing so is not often the best decision.

If couples file tax returns individually, it involves more work. However, your effort might result in tax benefits under appropriate circumstances. For instance, if one partner has a high level of medical expenditures, like COBRA expenses due to an employment loss, filing taxes separately may allow for a more significant deduction.

Filing separate returns has disadvantages, such as missing some exemptions provided to couple filers. To optimise your return potential, you’ll be required to consider this carefully. In addition, both couples must take the standard deduction or have to maximise their deductions in file tax return.

Accept tax breaks

You’ll never be informed of several deductions, and many of them are frequently disregarded. The deductions you are eligible for might significantly impact the overall tax refund. They are as follows:

State sales tax: You may calculate what amount of your local and state sales taxes users can deduct through the IRS’s tax return preparer.

Dividend reinvestment: While not strictly a deduction, this can lower your total tax obligation. Income from mutual funds is automatically included in the cost. Whenever you sell your stock, you may be able to lower your tax return on capital.

Contributions made out of pocket – Large gifts aren’t the only method to reduce tax liability. Make a note of the eligible minor costs, such as the materials for the delicious cake given to the fundraiser. You might be amazed at how rapidly a few generous donations here & there can reduce your tax liability. And a tax return preparer helps you with any problems that arise in the midst of filing.

Student loan interest: Although if you did not pay it personally, you could deduct it if you are the person who is responsible for paying. If somebody else settles the debt, the IRS refund considers it whenever a person was handed the funds and utilized them to finance the student loan. You would’ve qualified for the deductions if you met all the conditions.

Make the most of your IRA & HSA investments

To create or invest in a conventional IRA for the preceding tax refund year, customers have till the filing date. This provides you the option of claiming your refund on your tax, filing earlier, and opening the account with your refund.

- Contributions to a traditional IRA might lower your tax liability. You may make the maximum contributions, and if users are at least Fifty yrs. old, the hold option can help you grow the IRS refund.

- Although contributions to a Hybrid IRA are not deductible, they apply for the beneficial Saver’s Bonus if you satisfy specific income

They are contributing to a Health Savings Account (HSA) before tax returns might potentially lower your taxable earnings. One can also make changes up to the filing date. To open & donate to an HSA, the following conditions must be met:

- One must be registered in a health insurance policy with high expenditures that match or surpass the required levels set by the IRS lookup.

- This plan must also include the maximum yearly out-of-pocket expense caps required by the IRS lookup.

Remember that timing might increase your tax refund

Taxpayers who keep an eye on the calendar have a better chance of receiving a greater return. Search for tax-deductible transactions or contributions you may make until the end of the year. You can consult tax professionals about how to boost tax returns. As an example:

If possible, make your January loan payment until December 31 to receive the additional interest on the mortgage’s interest exemption with IRS lookup.

Schedule medical treatments and tests in the fourth quarter to maximize the medical cost deduction.

If users are self-employed, consider any expenditures you’ll have to take that can be deducted. Purchase items such as office devices and technology well before the year-end to increase your refund by IRS lookup.

If you qualify for the home workplace deduction, one could even reduce the expense of renovating your housework when you wish to begin a new term with a clean slate.

Learn about tax credits

Tax credits often perform better as refund boosters than deductions since they provide a dollar-for-dollar decrease in taxes. If you receive a $100 refund, your taxes are reduced by

$100. Most Americans leave money on their board whenever it pertains to receiving tax refunds. The significance of timely filing of tax returns and other legal papers (as relevant in one’s circumstances) could be overstated—the same aids in putting up correct tax records for future inquiry/ confirmation by the tax professionals.

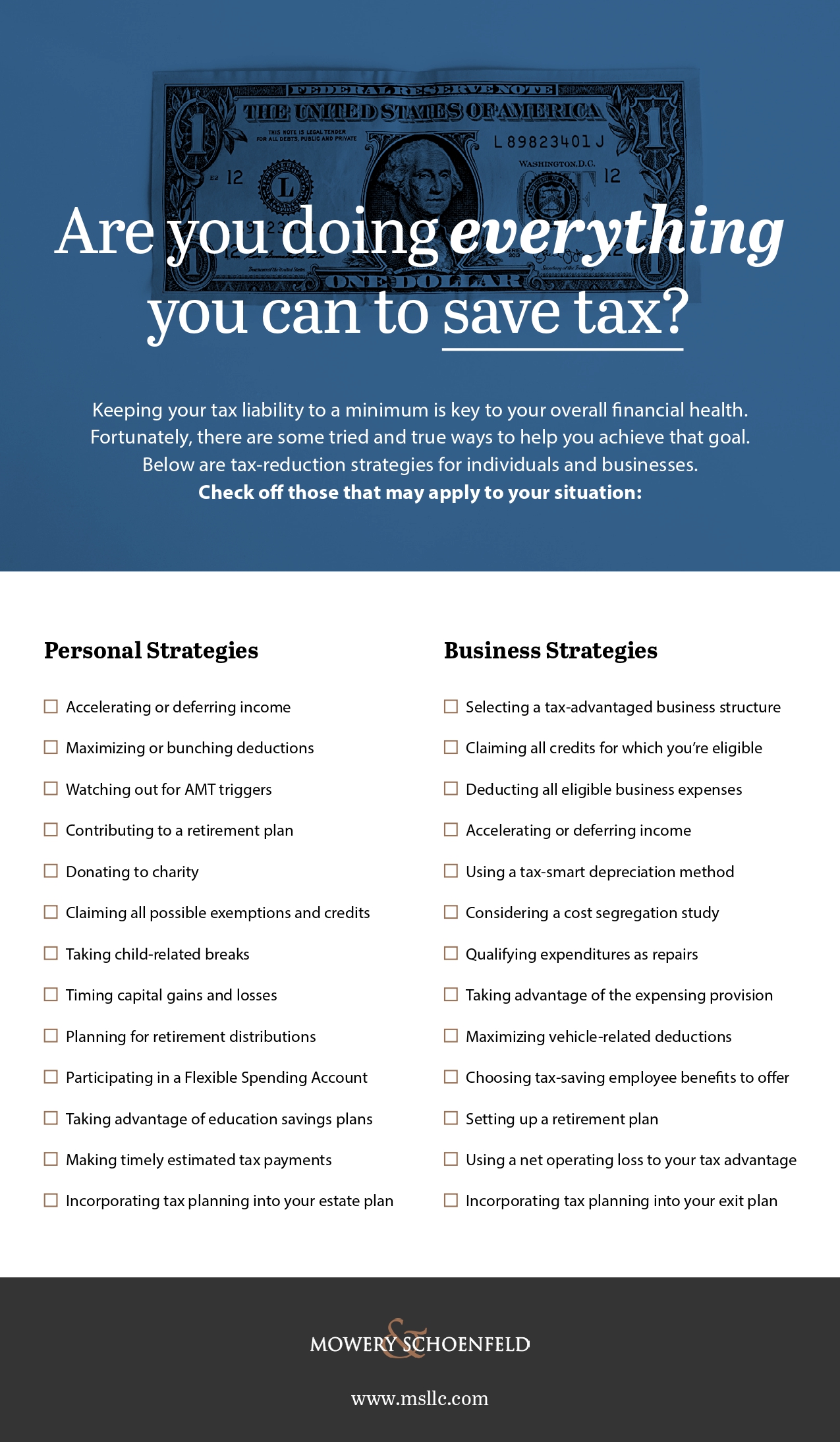

Check out the infographic below for more tips to save tax dollars!

Infographic provided by Mowery & Schoenfeld, LLC., a Chicago business tax service provider