The Importance of Professional Financial Planning

Financial planning is a process of assessing one’s current financial situation, identifying financial goals, and creating a plan to achieve them. It involves analyzing income, expenses, assets, and liabilities to determine a person’s financial health and develop a road map to help them achieve their financial goals. Professional financial planning is a critical aspect of achieving financial success, and it offers numerous benefits. In this article, we will explore the importance of professional financial planning and why it is essential to engage a professional financial planner to guide us through the process.

Setting Realistic Goals

Professional financial planners are trained to help individuals set realistic financial goals based on their income, expenses, and future aspirations. They help clients identify what they want to achieve financially, whether it is saving for retirement, buying a house, or starting a business. Setting realistic goals is critical because it helps individuals focus their financial efforts and prioritize their spending. With a clear understanding of their financial goals, individuals are more likely to stick to their budget and stay motivated to achieve their objectives.

Creating a Budget

One of the most important aspects of financial planning is creating a budget. A budget is a plan that outlines how individuals will spend their money over a set period. Professional financial planners can help individuals create a budget that aligns with their financial goals, income, and expenses. They can help identify areas where individuals can cut back on expenses and allocate more funds towards savings and investments. With a well-planned budget, individuals can avoid overspending, reduce debt, and save more money for the future.

Managing Debt

Professional financial planners can also help individuals manage their debt. Debt can be a significant obstacle to achieving financial goals, and it can quickly spiral out of control if not managed correctly. Financial planners can help individuals prioritize their debt payments, negotiate with creditors, and develop a debt repayment plan that fits their budget. By managing debt effectively, individuals can improve their credit score, reduce stress, and free up more funds for savings and investments.

Investing for the Future

Investing is a crucial part of financial planning, and it can help individuals achieve their long-term financial goals. Professional financial planners can help individuals identify the best investment options based on their risk tolerance, time horizon, and financial goals. They can also help individuals diversify their investment portfolio to minimize risk and maximize returns. With a well-planned investment strategy, individuals can build wealth over time and achieve financial security for themselves and their families.

Tax Planning

Taxes can have a significant impact on an individual’s financial situation. Professional financial planners can help individuals plan for taxes by identifying tax-saving opportunities and developing strategies to minimize tax liabilities. They can also help individuals stay up-to-date on tax laws and regulations to ensure compliance and avoid penalties. By planning for taxes, individuals can reduce their tax burden and keep more of their hard-earned money.

Retirement Planning

Retirement planning is another critical aspect of financial planning. Professional financial planners can help individuals determine how much they need to save for retirement, identify the best retirement savings options, and develop a retirement income plan. They can also help individuals plan for unexpected events, such as healthcare costs or a decline in the stock market. With a well-planned retirement strategy, individuals can retire comfortably and achieve their retirement goals.

Risk Management

Risk management is an essential aspect of financial planning. Professional financial planners can help individuals identify potential risks, such as job loss, disability, or death, and develop strategies to mitigate them. They can also help individuals protect their assets and income with insurance policies, such as life insurance, disability insurance, and long-term care insurance. By managing risks effectively, individuals can protect themselves and their families from financial hardships.

The Way Ahead

To ensure that you are successfully managing your financial affairs for the future, you need to know what kind of future, exactly, you are planning for. What are the goals that will help you reach those longer objectives and, preferably with the help of a professional, what steps must you take to reach them?

Use the enquiry form on our website to send us a quick message or enquire about the services that Gale and Phillipson provide. We’ll make sure you get to speak to a practical and experienced local financial adviser best suited to your needs.

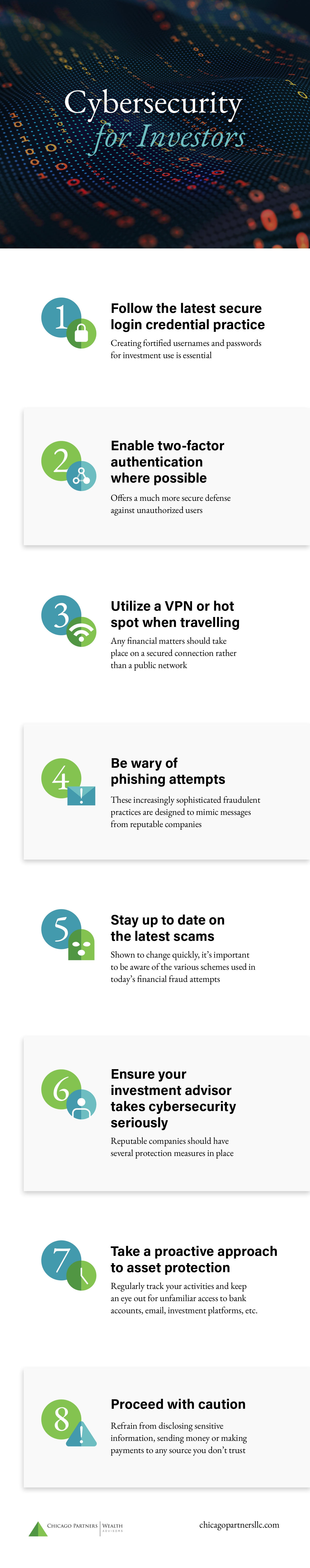

No matter how you decide to invest your money, make sure you are practicing the best security measures to keep your money safe. Please see the helpful infographic below for more information.

Provided by Chicago Partners – providing wealth management for high net worth individuals