How UPI Transactions Have Evolved Over the Years

The Unified Payment Interface (abbreviated as UPI) was created by the Reserve Bank of India and developed by the National Payments Corporation of India (commonly known as NPCI) as a real-time payments and money transfer alternative for individuals who are unfamiliar with its complicated features.

The service was created on top of an already-existing architecture and network, with all bank accounts linked via IMPS (Immediate Payments Service).

Users may conduct real-time transactions using a brand-new securID where there is no UPI transaction limit per day. UPI had a difficult start when it first came in August 2016.

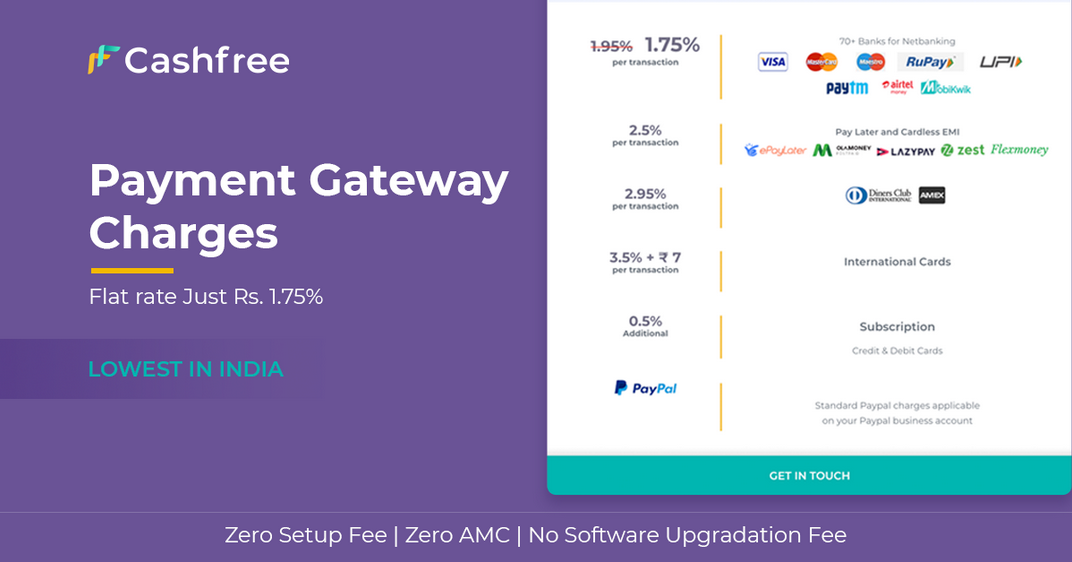

India took its time developing faith in UPI as a safe payment system, just as it did with any previous groundbreaking technology discovery. There are several payment system providers like cashfree payments that offer payment system setup services to merchants.

How UPI Has Changed Over Time

UPI payments were accepted in practically every business in a couple of months, from local general stores to huge hypermarket chains. In less than two years, UPI transaction volumes surged more than 123 times with transaction values increasing 58 times, from INR 7 billion to INR 408 billion.

According to current figures, UPI usage has increased drastically to the next levels. All of this has been made possible by a number of clever government measures and other benefits such as UPI transaction limit per day, no extra cost of transferring money and among others.

Some of them have had a more favourable appeal, such as rewarding customers and merchants through schemes and discounts, no UPI transaction limit per day, demonetization, that had to resist the harsh reactions from users.

All of these regulations, in one way or another, have aided UPI’s huge development and quick acceptance.

The ‘Wallet’ which is very much useful for business

Merchants’ daily operations are simplified with the introduction of UPI, which allows them to accept payments and enable in-app transactions all in one spot. There is also no UPI transaction limit per day which is an added advantage.

When compared to traditional payment methods, shops may use UPI to make payments using their mobile phones, lowering transaction costs significantly. Towards the start, there was only one version of the emerging technology, but there is now a second one. The current version is more merchant-focused with features like:

- Ability to pre-authorize a transaction with the option to pay later, which benefits both customers and merchants.

- The option to link overdraft accounts on UPI, which will fuel more transactions in the ecosystem; and enhanced verification, which will decrease fraud.

What comes next?

Although merchant transactions have drastically increased over a period, there is still a long way to go in the offline merchant arena. Banks are optimistic about this potential and expect it will be realized shortly. In addition to physical and eCommerce stores, the UPI method which has no UPI transactions limit per day is expected to expand potential in credit, insurance, wealth management, and loyalty, among other sectors.

Whether it’s for person-to-person or person-to-merchant transactions, UPI was created with the goal of making digital payments simple and available to everyone, and it has been most effective in moving India toward a “cashless” economy.

What will be fascinating to observe is how diverse ecosystem actors contribute and collaborate to make this a payment product that the rest of the world aspires to. One thing is certain: real-time and digital payment technologies, such as UPI, will continue to exist in the future.

Conclusion

Payments are evolving; real-time systems are being introduced throughout the world, and digital transformation is becoming the norm. And, in India, the junction of these two global developments makes the payments business a very interesting place to be – let’s see what the next few years bring in India and beyond!